REGIONAL Mobile Deposit Frequently Asked Questions

Yes! Please endorse the check "Deposited via mobile deposit – REGIONAL fcu" below your signature prior to submitting.

Example:

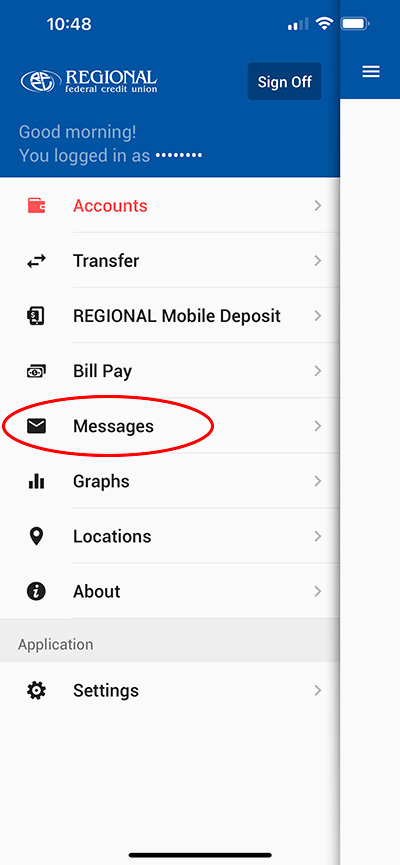

Checks are reviewed throughout the day. You can review the check history to confirm if there are any issues with your check deposit. You will also receive a message in the REGIONAL Mobile app.

Yes. It's a good idea to hold onto all checks you deposit until you can confirm the funds are in your account. Once confirmed, be sure to safely destroy them.

All checks should be entered with the written amount.

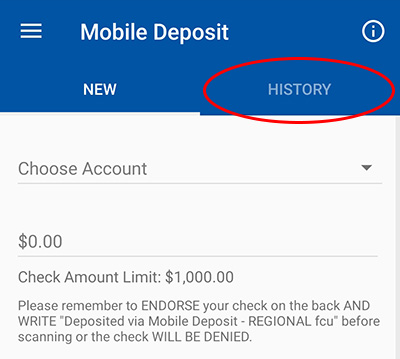

On the top of the REGIONAL Mobile Deposit page, you can click the History tab to view the full history of your mobile deposits.

To qualify for REGIONAL Mobile Deposit your account must meet these requirements:

- Account open over 90 days;

- No Chex System entries (no outstanding negative activity at other financial institutions);

- Credit score 650 and above;

- Must have checking account;

- Members must be in active status for over 90 days (no dormancy);

- Member must not have caused any loss to REGIONAL (loans or shares);

- Member account must be in good standing (no delinquency or negative share balances) for over 90 days.

No, REGIONAL Mobile Deposit is a free feature within the REGIONAL Mobile App.

Your maximum deposit limit depends on your length of membership, account history, and credit score. Your deposit limit is listed in the REGIONAL Mobile app on the Mobile Deposit page.

No, there is no minimum deposit at this time.

Checks are reviewed throughout the day and typically post at approximately 9:00 a.m., 12:20 p.m. and 4:30 p.m. Monday through Friday. Any checks submitted after 4:00 pm will be posted to the account the next business day at approximately 9:00 am. Checks posted after 4:00 p.m. Friday and throughout the weekend will be processed on Monday morning. Please be aware some checks may have a hold placed on them for a number of factors. If you have a question about a certain check before mobile depositing, you may call us at 1-800-762-7419 to speak with a team member.

There is no limit on the number of checks you can deposit each day. However, there is a daily limit on the dollar amount. This limit is based on your account history, along with other factors.

For security reasons, there are certain aspects of each check that must be clearly identifiable with each photo image. If any of these aspects are not clearly identifiable, your mobile check deposit may be rejected. Here are a few tips for best photo quality:

- Lay the check on a flat, well-lit surface. If the check is crumpled or folded, do your best to flatten it out;

- If you have a check with a light background, be sure to take the picture on a solid, darker surface to show contrast between check and background;

- Be sure that all four corners of your check are entirely within the frame that is provided on the screen.

Go to the "Messages" feature in the REGIONAL Mobile app. We will automatically send you a message with the reason the deposit failed.

This information will not be present under the "History" tab; mobile deposit history will simply show that the deposit was rejected.

Keep in mind that incorrect endorsement is the most common reason mobile deposits are rejected. Be sure you have endorsed your check properly!

Yes, you can still present the check in branch; however it may be placed on an extended hold while we research whether the check has already cleared with the restricted endorsement.

No, this is considered a third-party check and cannot be deposited through our remote deposit system. You may only deposit checks made out to you or you and a joint account holder.

No, only United States checks can be processed through REGIONAL Mobile Deposit. Foreign checks may be processed at the branch.